Cambridge lawyers advise on Coyote Software sale to InvestorFlow

The Birketts team was led by James Allen (Partner, Corporate) and Quentin Golder (Partner, Commercial and Technology) in Cambridge.

Allen and Golder were assisted by Anastasia Whitlock (Associate, Corporate), Macauley Alsford (Solicitor, Corporate), Samantha Woodley (Senior Associate, Commercial and Technology), Karl Pocock (Partner, Corporate Tax), Robbie Watson (Senior Associate, Corporate Tax) and Emma Nel (Solicitor, Corporate Tax).

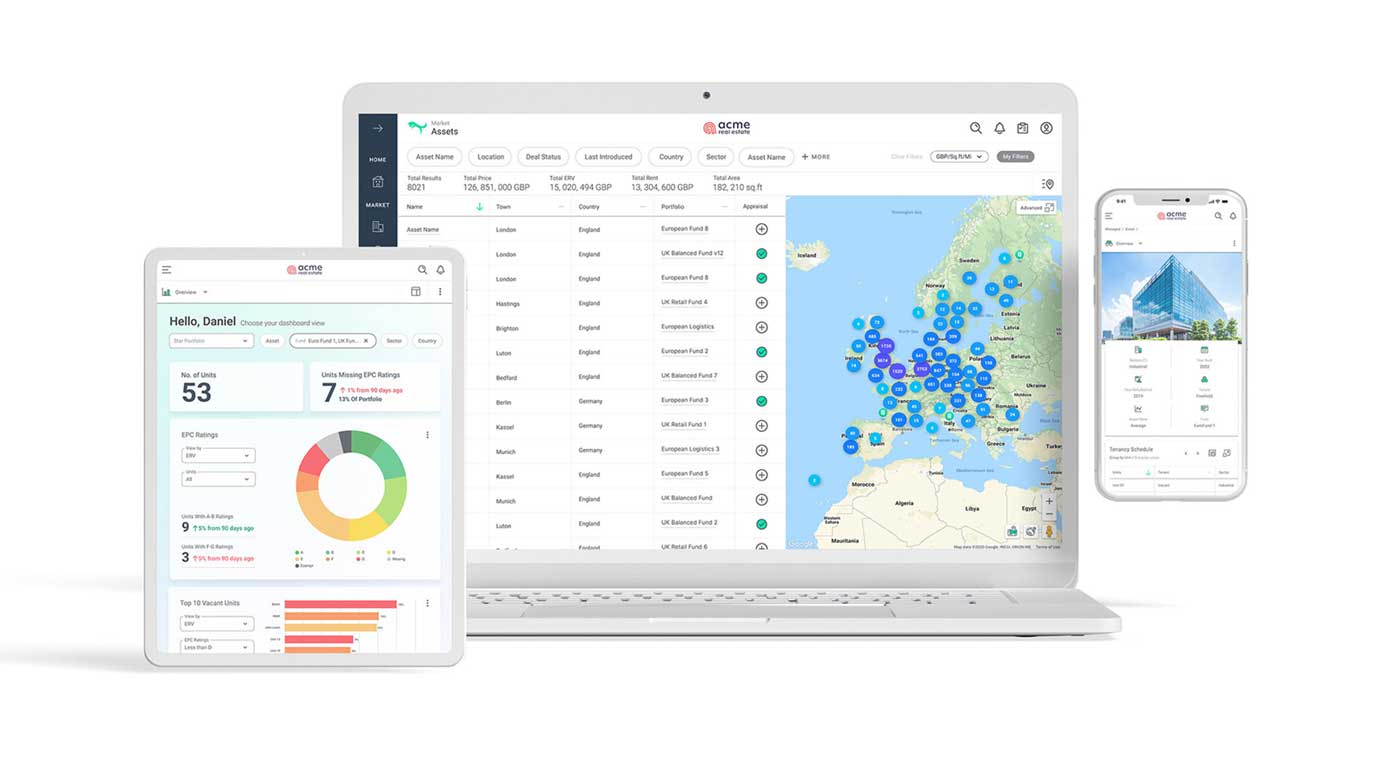

Coyote Software Limited, along with its US subsidiary, is a real estate software platform provider offering platform solutions to consolidate real estate data, manage portfolio performance and risk and provide performance insights founded in 2009.

Coyote’s enterprise-class capabilities are proven with clients such as Nuveen, LGIM, and Royal London Asset Management. The platform has 80,000 assets with more than 500 million square feet managed today.

InvestorFlow is an industry-leading cloud-based platform for alternative investment firms based in Menlo Park, California, with offices in New York and London. 25 of the top 50 US alternative asset managers are currently powered by Investorflow which is more than $6 trillion in assets under management, 750 funds and 90,000 limited partners.

InvestorFlow Chairman and CEO, Todd Glasson said: “The combination of Coyote with InvestorFlow’s CRM and portal capabilities for fundraising and investor relations helps us complete our vision for an end-to-end industry cloud for CRE that drives collaboration across the real estate investment lifecycle from limited partners to property managers.

“As a result of this transaction, we will have large and growing team in London that can support our customers throughout Europe and into Asia. We will now have 18 hours of continuous coverage around the globe. We plan to grow our team in London to support our growth and expand InvestorFlow’s full suite of solutions into Europe.

“To date, while InvestorFlow supports many international teams of domestic companies, we’ve had only a handful of customers domiciled in Europe. With this transaction, we now have well over 50 customers in Europe and expect to grow this number significantly.

“While I was excited about the strategy of buying a company in London to accelerate our growth in Europe, I was concerned about cultural differences. Oli Farago, CEO and Co-Founder of Coyote, has built an incredible team and culture that is surprisingly very similar to our culture at InvestorFlow.

“We have both built companies that are client focused and driven by excellence. I am excited to have Oli and the team join us on our new combined journey to build the most powerful platform in the CRE industry and bring it around the globe.”

The Birketts team worked closely with Mark Shewring, Tanya Yeremenko and Dominic Noakes at Haysmacintyre LLP along with US Counsel, Roddy Bailey and Carson Heyer at Holland & Knight LLP.

On completing the transaction James Allen said: “We were really pleased to have acted on this deal. I wish Oli and the team at Coyote the best as they enter into this new phase with InvestorFlow, and I look forward to seeing what the future holds.

“It was a pleasure to work with the shareholders and the management team to ensure the transaction ran as smoothly as possible and to input with our experience to reach a positive outcome for all involved.”

Oli Farago added: “I can’t thank the Birketts team enough for their hard work in getting this deal over the line. Their constant support, attention to detail and expert advice was instrumental in the success of the transaction and we could not have done it without them.”